Is There Tax On Used Vehicles In Bc . The bc government will begin charging new pst tax rates based on the vehicles value, not the negotiated price in. a new rule means people buying cars in private sales are paying taxes on the list value of used cars, as opposed to the actual sales cost. tax on privately acquired vehicles in b.c. if you buy a used car in british columbia, through private sale, expect to pay provincial sales tax (pst). If you purchase a vehicle in a private sale or receive it as a gift in certain. bc used car taxes are changing in 2022. For use on october 1, 2022. You must pay pst on vehicles you purchase, lease or receive as a gift in b.c., and vehicles you purchase, lease or receive as a gift. Applicable depreciation is calculated using the formula:. you bring the motor vehicle into b.c. Government says it will generate an estimate $30 million annually with a new policy to more vigorously tax.

from www.cashforcars.ca

For use on october 1, 2022. Government says it will generate an estimate $30 million annually with a new policy to more vigorously tax. Applicable depreciation is calculated using the formula:. You must pay pst on vehicles you purchase, lease or receive as a gift in b.c., and vehicles you purchase, lease or receive as a gift. bc used car taxes are changing in 2022. you bring the motor vehicle into b.c. If you purchase a vehicle in a private sale or receive it as a gift in certain. if you buy a used car in british columbia, through private sale, expect to pay provincial sales tax (pst). The bc government will begin charging new pst tax rates based on the vehicles value, not the negotiated price in. tax on privately acquired vehicles in b.c.

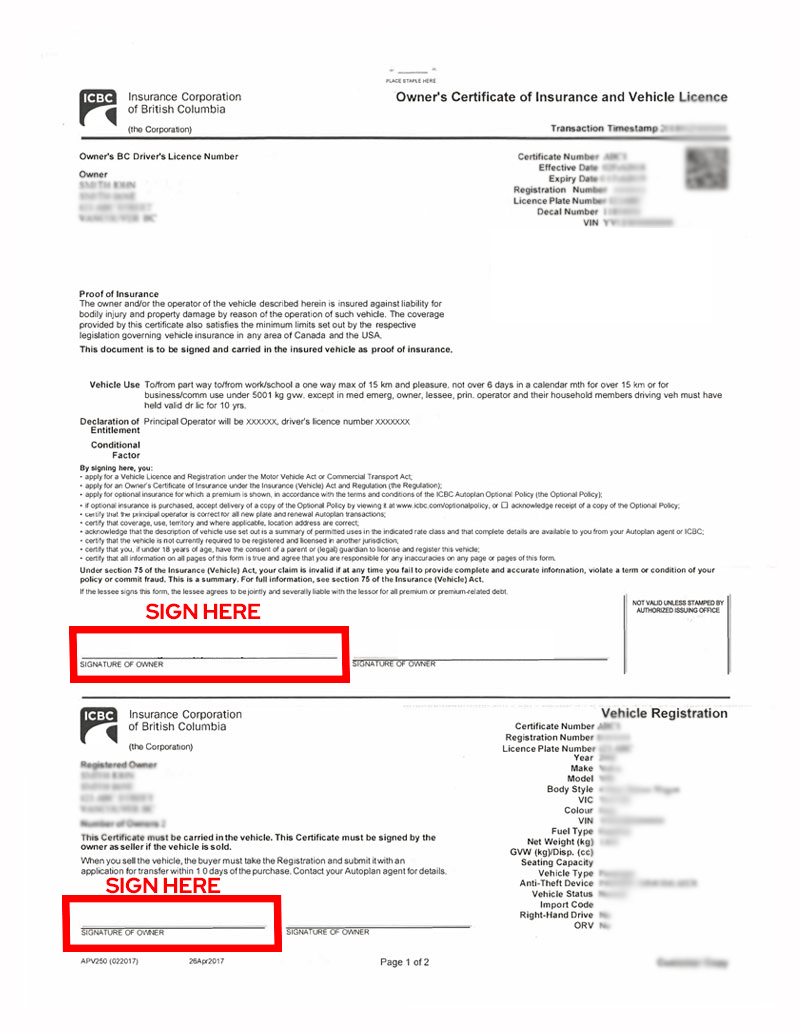

How to Sign and Submit Your Vehicle Ownership in Canada Cashforcars.ca

Is There Tax On Used Vehicles In Bc The bc government will begin charging new pst tax rates based on the vehicles value, not the negotiated price in. you bring the motor vehicle into b.c. bc used car taxes are changing in 2022. Applicable depreciation is calculated using the formula:. You must pay pst on vehicles you purchase, lease or receive as a gift in b.c., and vehicles you purchase, lease or receive as a gift. tax on privately acquired vehicles in b.c. For use on october 1, 2022. The bc government will begin charging new pst tax rates based on the vehicles value, not the negotiated price in. If you purchase a vehicle in a private sale or receive it as a gift in certain. Government says it will generate an estimate $30 million annually with a new policy to more vigorously tax. a new rule means people buying cars in private sales are paying taxes on the list value of used cars, as opposed to the actual sales cost. if you buy a used car in british columbia, through private sale, expect to pay provincial sales tax (pst).

From www.team-bhp.com

Indian Car "OnRoad Pricing" explained Exshowroom prices, taxes Is There Tax On Used Vehicles In Bc If you purchase a vehicle in a private sale or receive it as a gift in certain. bc used car taxes are changing in 2022. tax on privately acquired vehicles in b.c. Applicable depreciation is calculated using the formula:. a new rule means people buying cars in private sales are paying taxes on the list value of. Is There Tax On Used Vehicles In Bc.

From www.pakwheels.com

Government to impose a new bag of taxes on vehicles PakWheels Blog Is There Tax On Used Vehicles In Bc bc used car taxes are changing in 2022. You must pay pst on vehicles you purchase, lease or receive as a gift in b.c., and vehicles you purchase, lease or receive as a gift. If you purchase a vehicle in a private sale or receive it as a gift in certain. you bring the motor vehicle into b.c.. Is There Tax On Used Vehicles In Bc.

From cqca.ca

Navigating ICBC’s Black Book Tax Calculations for Used Vehicles Is There Tax On Used Vehicles In Bc a new rule means people buying cars in private sales are paying taxes on the list value of used cars, as opposed to the actual sales cost. Applicable depreciation is calculated using the formula:. For use on october 1, 2022. The bc government will begin charging new pst tax rates based on the vehicles value, not the negotiated price. Is There Tax On Used Vehicles In Bc.

From blog.tax2290.com

Prorated Form 2290 Taxes for April Used Vehicles are Due by the End of Is There Tax On Used Vehicles In Bc The bc government will begin charging new pst tax rates based on the vehicles value, not the negotiated price in. a new rule means people buying cars in private sales are paying taxes on the list value of used cars, as opposed to the actual sales cost. If you purchase a vehicle in a private sale or receive it. Is There Tax On Used Vehicles In Bc.

From cartaxcheck.zendesk.com

When is my vehicle tax due? Car Tax Check Is There Tax On Used Vehicles In Bc For use on october 1, 2022. Applicable depreciation is calculated using the formula:. tax on privately acquired vehicles in b.c. a new rule means people buying cars in private sales are paying taxes on the list value of used cars, as opposed to the actual sales cost. If you purchase a vehicle in a private sale or receive. Is There Tax On Used Vehicles In Bc.

From www.formsbirds.com

Vehicle Transfer/Tax Form British Columbia Free Download Is There Tax On Used Vehicles In Bc Government says it will generate an estimate $30 million annually with a new policy to more vigorously tax. The bc government will begin charging new pst tax rates based on the vehicles value, not the negotiated price in. If you purchase a vehicle in a private sale or receive it as a gift in certain. You must pay pst on. Is There Tax On Used Vehicles In Bc.

From www.trucktax.com

EFile Your Truck Tax Form 2290 Highway Heavy Vehicle Use Tax Is There Tax On Used Vehicles In Bc you bring the motor vehicle into b.c. Applicable depreciation is calculated using the formula:. Government says it will generate an estimate $30 million annually with a new policy to more vigorously tax. a new rule means people buying cars in private sales are paying taxes on the list value of used cars, as opposed to the actual sales. Is There Tax On Used Vehicles In Bc.

From privateauto.com

How Much are Used Car Sales Taxes in Indiana? Is There Tax On Used Vehicles In Bc if you buy a used car in british columbia, through private sale, expect to pay provincial sales tax (pst). tax on privately acquired vehicles in b.c. Government says it will generate an estimate $30 million annually with a new policy to more vigorously tax. Applicable depreciation is calculated using the formula:. The bc government will begin charging new. Is There Tax On Used Vehicles In Bc.

From www.youtube.com

How to Calculate Sales Tax on used Cars in Pakistan YouTube Is There Tax On Used Vehicles In Bc if you buy a used car in british columbia, through private sale, expect to pay provincial sales tax (pst). If you purchase a vehicle in a private sale or receive it as a gift in certain. Applicable depreciation is calculated using the formula:. a new rule means people buying cars in private sales are paying taxes on the. Is There Tax On Used Vehicles In Bc.

From www.vrogue.co

The 10 Cheapest New Cars With No Road Tax Top Cheap Vrogue Is There Tax On Used Vehicles In Bc Applicable depreciation is calculated using the formula:. If you purchase a vehicle in a private sale or receive it as a gift in certain. bc used car taxes are changing in 2022. you bring the motor vehicle into b.c. a new rule means people buying cars in private sales are paying taxes on the list value of. Is There Tax On Used Vehicles In Bc.

From privateauto.com

How Much Are Used Car Sales Taxes in Texas? Is There Tax On Used Vehicles In Bc Applicable depreciation is calculated using the formula:. Government says it will generate an estimate $30 million annually with a new policy to more vigorously tax. For use on october 1, 2022. The bc government will begin charging new pst tax rates based on the vehicles value, not the negotiated price in. You must pay pst on vehicles you purchase, lease. Is There Tax On Used Vehicles In Bc.

From www.carscoops.com

The Complete List Of Eligible Cars For The 7,500 EV Tax Credit Carscoops Is There Tax On Used Vehicles In Bc The bc government will begin charging new pst tax rates based on the vehicles value, not the negotiated price in. tax on privately acquired vehicles in b.c. if you buy a used car in british columbia, through private sale, expect to pay provincial sales tax (pst). Applicable depreciation is calculated using the formula:. you bring the motor. Is There Tax On Used Vehicles In Bc.

From exoaxkrxh.blob.core.windows.net

Car Sales Tax Rate California at Ruth Tapscott blog Is There Tax On Used Vehicles In Bc a new rule means people buying cars in private sales are paying taxes on the list value of used cars, as opposed to the actual sales cost. you bring the motor vehicle into b.c. If you purchase a vehicle in a private sale or receive it as a gift in certain. The bc government will begin charging new. Is There Tax On Used Vehicles In Bc.

From theautoexperts.co.uk

Car tax band rates Complete guide for road tax UK The Auto Experts Is There Tax On Used Vehicles In Bc If you purchase a vehicle in a private sale or receive it as a gift in certain. a new rule means people buying cars in private sales are paying taxes on the list value of used cars, as opposed to the actual sales cost. if you buy a used car in british columbia, through private sale, expect to. Is There Tax On Used Vehicles In Bc.

From blog.tax2290.com

Tomorrow is the last date to efile prorated form 2290 taxes for Is There Tax On Used Vehicles In Bc a new rule means people buying cars in private sales are paying taxes on the list value of used cars, as opposed to the actual sales cost. The bc government will begin charging new pst tax rates based on the vehicles value, not the negotiated price in. You must pay pst on vehicles you purchase, lease or receive as. Is There Tax On Used Vehicles In Bc.

From privateauto.com

How Much are Used Car Sales Taxes in Kentucky? Is There Tax On Used Vehicles In Bc Government says it will generate an estimate $30 million annually with a new policy to more vigorously tax. if you buy a used car in british columbia, through private sale, expect to pay provincial sales tax (pst). Applicable depreciation is calculated using the formula:. bc used car taxes are changing in 2022. The bc government will begin charging. Is There Tax On Used Vehicles In Bc.

From www.driving.co.uk

Without a tax disc, how can I check that my vehicle is still taxed? Is There Tax On Used Vehicles In Bc you bring the motor vehicle into b.c. You must pay pst on vehicles you purchase, lease or receive as a gift in b.c., and vehicles you purchase, lease or receive as a gift. For use on october 1, 2022. a new rule means people buying cars in private sales are paying taxes on the list value of used. Is There Tax On Used Vehicles In Bc.

From blog.tax2290.com

Form 2290 Truck Taxes for the vehicles first used on January 2023 is Is There Tax On Used Vehicles In Bc Government says it will generate an estimate $30 million annually with a new policy to more vigorously tax. you bring the motor vehicle into b.c. Applicable depreciation is calculated using the formula:. The bc government will begin charging new pst tax rates based on the vehicles value, not the negotiated price in. bc used car taxes are changing. Is There Tax On Used Vehicles In Bc.